IRS EITC Assistant

Here is 10 Step How-to

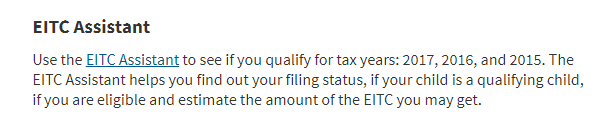

The EIC Assitant is provided by the IRS to help people know whether or not they qualify for this tax refund. It’s not the easiest thing to use, so we have provided this How-to.

Answering all the questions might take ten minutes or so. But if you are eligible for hundreds of dollars, it would be time well-spent.

Here’s what to expect when you go

1. You will go to the IRS website.

By using this Assistant, you are not doing anything official. You cannot use this to file taxes. The Assistant will guide you through a series of questions that will tell you whether you qualify for the Earned Income Tax Credit (EITC). You can use the link on the Ties That Bind page. Or, click here.

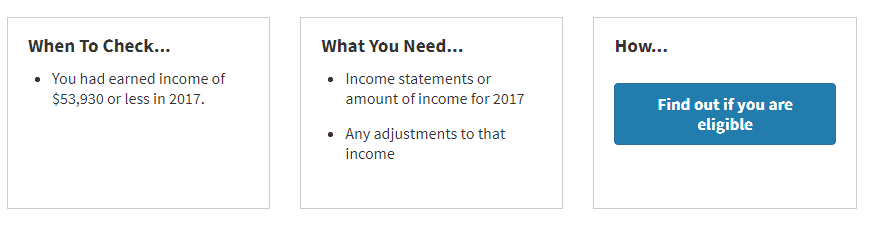

2. Scroll down the IRS page to find this:

Don’t worry too much about income statements. Just know how much you earned last year. Click on the dark blue box to start.

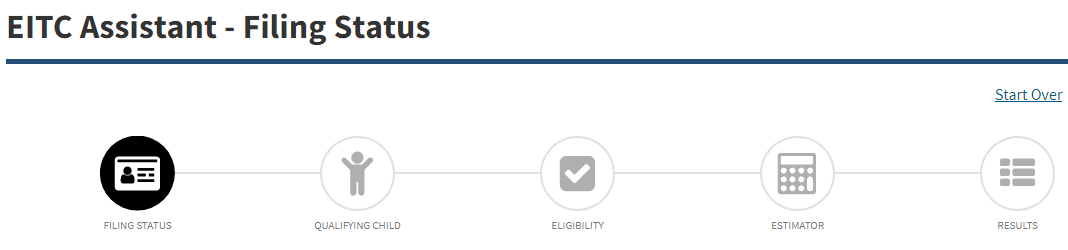

3. Follow your progress.

You will be answering quite a few questions. You can see how you are doing at the top of the page.

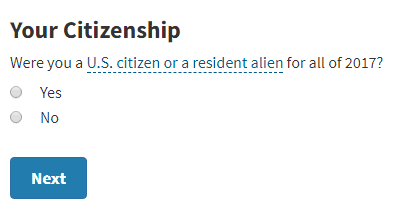

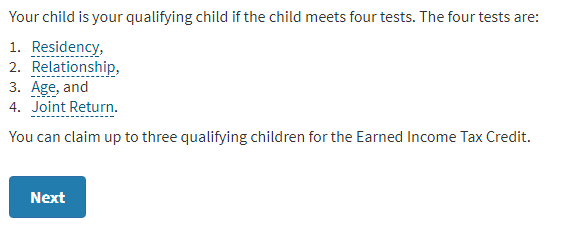

4. Ok, ready? First question.

Click on the correct answer and then click on Next.

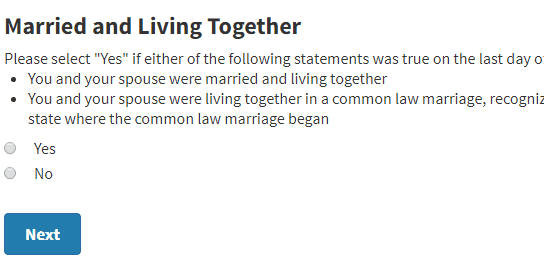

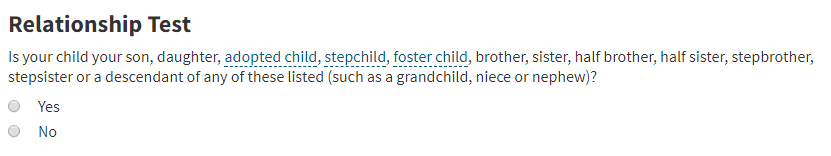

5. Example of other questions

You will also get guidance as you go.

6. Notice that “grandchildren” count!

If you have a grandchild living with you, mark Yes.

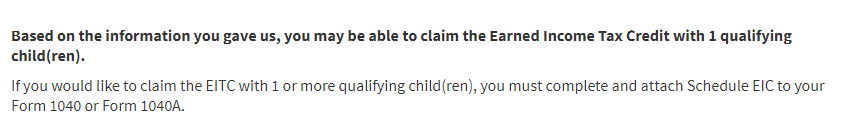

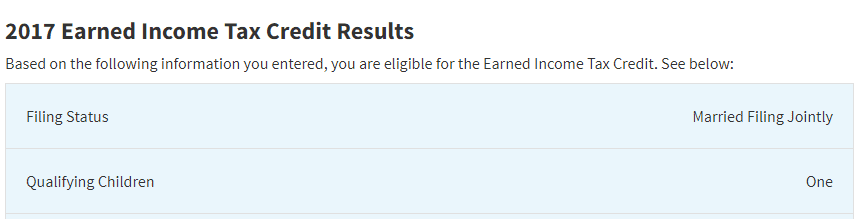

7. If you qualify, here is what you’ll see

Pretty low key, isn’t it? But this is the important confirmation that you qualify.

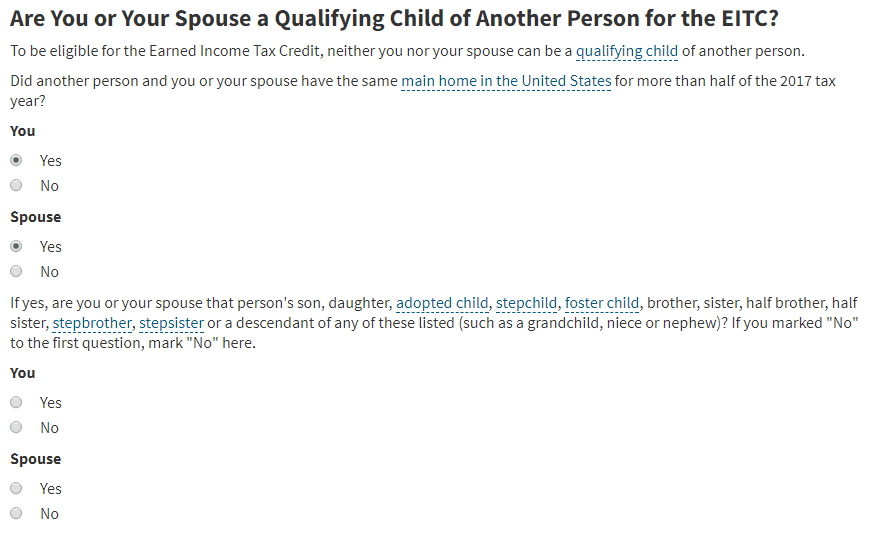

(Help on a confusing question.)

Ha! No one is claiming you a child on their taxes. Not likely. So check No.

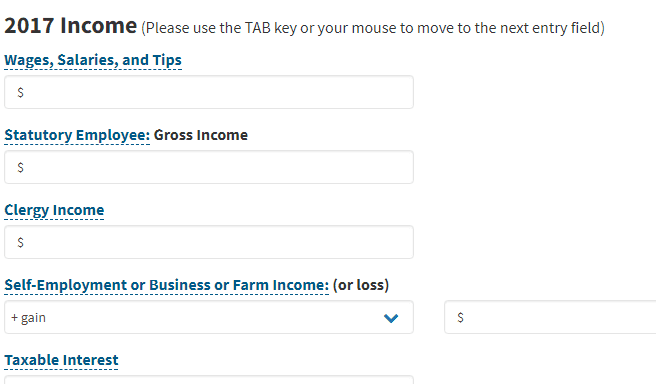

8. Add up your income from last year.

Fill in the boxes as completely as possible. Don’t worry if you do not have all the paperwork yet. You will need that later when you file. This information is just so that the IRS can estimate the amount of your refund.

9. That’s it! Done.

Print or share results via email.

You could email the results to yourself to have handy when it comes to filing your taxes.

Bonus: See if you qualify for even more $