Some grandparents raising grandchildren qualify for cash back from the IRS through the Earned Income Tax Credit – learn more

Yes, everything to do with taxes is stressful. But this tax credit is real money meant to help people on stretched budgets, including grandparents. Yet, in Oregon, 1 in 4 families is missing out on this money. Follow the four steps below to see if the government has a check for up to $6,000 waiting for you. Please watch the video above for more information.

What is the EITC?

The Earned Income Tax Credit (EITC) provides relief for some workers at tax time. If you qualify, the tax credit lowers the amount of taxes you are required to pay. If you don’t owe taxes, you get the money as a refund check.

Do I qualify?

First, has a child in your care lived with you for at least 6 months? If yes, you may be able to claim the child on your income taxes. From there, there are three main eligibility requirements to claim the EITC.

1) You must have earned at least some money. This income can be from wages, salary, tips, employer-based disability, self-employment income, military pay, or union strike benefits.

2) You don’t make over a certain amount of money, (check with the estimator below). And your income from interest must be less than $3,600.

3) You must have social security numbers for you, your spouse (if applicable) and any children claimed.

Key Takeaway: If you earned money in the most recent tax year and you have grandchildren living with you, the IRS may have a big check for you. But, you must file a tax return.

Steps to Getting your Money

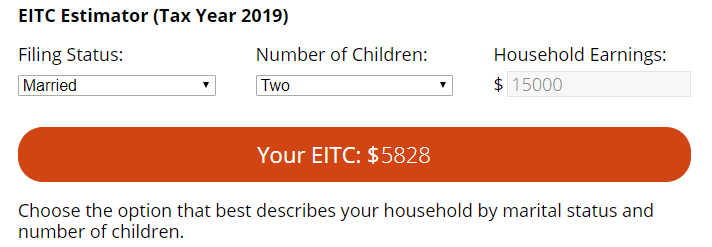

How much money? Go to this handy estimator (click image below).

Don’t worry about the details, yet. Just click and fill in how much money you or your partner were paid for work–not Social Security, alimony, etc. Click on the button and fill in the blanks. It will take less than a minute.

Do we qualify? Can we claim our grandchildren?

The basic principle is simple: The child you are claiming must have lived with you for more than half of the year–and no one else can be claiming the child. Hear it straight from the IRS. Go to the link below and answer some anonymous questions. This step is a little more complicated than than the first one. If you need a hand, Click on the Step by Step How-To before going to the IRS webpage. When you are ready, give yourself 10 minutes to answer all the questions (scroll down the IRS Assitant page to the blue box).

Still have questions?

Does a grandparent need to have legal guardianship to claim a grandchild for the EITC?

No, legal guardianship of a child is not a requirement to claim the tax credits. Eligibility is based on income, the age of the grandchild, and whether the grandchild lived with the grandparent for more than six months of the year in total. As long as the grandparent meets the general requirements for these tax credits, the grandparent can claim the EITC.

Will claiming the EITC affect eligibility for other benefits?

For resource or asset tests, EITC is not counted for 12 months after the month the refund is received.

In a three-generation household, what happens if there is a change in the parent’s ability to raise the child due to unemployment, loss of income, military deployment, or divorce?

Who is eligible for the EITC in a three-generation household when both a child and parent live with the grandparent of the child?

In a three-generation household, what happens if the parent can no longer work and raise the child due to illness, disability, or incarceration?

Great. But I have more questions.

Or go to the ultimate authority, the IRS. Here is their Frequently Asked Questions page.